รายละเอียด : ศธ04009

สำนักพัฒนาระบบบริหารงานบุคคลและนิติการ

สำนักงานคณะกรรมการการศึกษาขั้นพื้นฐาน

รายละเอียด : ศธ04009ว7464 รหัสสังกัด สิ่งที่ส่งมาด้วย : 1 สพม.กรุงเทพฯ เขต 1 2 สพม.กรุงเทพฯ เขต 2 3 สพม.กาญจนบุรี 4 สพม.กาฬสินธุ์ 5 สพม.กำแพงเพชร 6 สพม.ขอนแก่น 7 สพม.จันทบุรี ตราด 8 สพม.ฉะเชิงเทรา 9 สพม.ชลบุรี ระยอง 10 สพม.ชัยภูมิ 11 สพม.เชียงราย 12 สพม.เชียงใหม่ 13 สพม.ตรัง กระบี่ 14 สพม.ตาก 15 สพม.นครปฐม 16 สพม.นครพนม 17 สพม.นครราชสีมา 18 สพม.นครศรีธรรมราช 19 สพม.นครสวรรค์ 20 สพม.นนทบุรี 21 สพม.นราธิวาส 22 สพม.น่าน 23 สพม.บึงกาฬ 24 สพม.บุรีรัมย์ 25 สพม.ปทุมธานี 26 สพม.ประจวบคีรีขันธ์ 27 สพม.ปราจีนบุรี นครนายก 28 สพม.ปัตตานี 29 สพม.พระนครศรีอยุธยา 30 สพม.พะเยา 31 สพม.พังงา ภูเก็ต ระนอง 32 สพม.พัทลุง 33 สพม.พิจิตร 34 สพม.พิษณุโลก อุตรดิตถ์ 35 สพม.เพชรบุรี 36 สพม.เพชรบูรณ์ 37 สพม.แพร่ 38 สพม.มหาสารคาม 39 สพม.มุกดาหาร 40 สพม.แม่ฮ่องสอน 41 สพม.ยะลา 42 สพม.ร้อยเอ็ด 43 สพม.ราชบุรี 44 สพม.ลพบุรี

Read more

ลิ้งแบบแสดงความคิดเห็นการประชาพิจารณ์ : แบบแสดงความคิดเห็นการประชาพิจารณ์ (ร่าง) กฎกระทรวงกำหนดหลักเกณฑ์และวิธีการให้คนพิการมีสิทธิได้รับสิ่งอำนวยความสะดวก สื่อ บริการ และความช่วยเหลืออื่นใดทางการศึกษา พ.ศ. ….

Read more

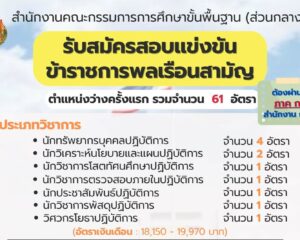

ไฟล์ประกาศรับสมัครสอบ : สมัครผ่านระบบออนไลน์ได้ที่ : https://obec.thaijobjob.com/

Read moreรายละเอียด :

Read moreรายละเอียด :

Read more